Every time you buy something online whether it’s a phone, a t-shirt, or even an eBook you’re part of an e-commerce transaction. It happens in seconds, but behind that smooth process lies a system of digital communication, security checks, and payment exchanges.

If you’re running (or planning to start) an online store, understanding what an e-commerce transaction really is can help you make smarter business decisions, improve customer trust, and build a better store experience overall.

Let’s dive deep into how e-commerce transactions work, their types, stages, security aspects, and why they’re the foundation of the online economy.

What Is an E-Commerce Transaction?

In simple terms, an e-commerce transaction is any exchange of goods, services, or information that happens over the internet.

It’s when a buyer and a seller digitally agree to a deal usually involving money without ever meeting physically.

For example:

- You buy a laptop from Amazon.

- You subscribe to Netflix.

- You purchase an online course or download software.

All of these are e-commerce transactions, because they happen electronically and involve a financial or value-based exchange.

So, in essence:

An e-commerce transaction = an online exchange between buyer and seller, completed through digital communication and payment.

The Basic Components of an E-Commerce Transaction

Every transaction, whether it’s small or large, includes three main parts:

1. The Buyer

The customer who initiates the transaction browsing products, placing an order, and making payment.

2. The Seller

The online store, marketplace, or service provider that lists products or services for sale.

3. The Digital Platform

This is where the exchange happens a website, mobile app, or marketplace platform like Shopify, Flipkart, Etsy, or Amazon.

Once the buyer finds what they want, places the order, and pays, the seller confirms, processes, and fulfills the transaction.

But it’s not always that simple — because different types of transactions exist in the e-commerce world.

Types of E-Commerce Transactions

Not every online transaction looks the same. E-commerce has multiple types based on who’s buying and who’s selling.

Let’s go through the main categories.

1. B2C (Business to Consumer)

This is the most common type — when businesses sell products directly to end consumers.

Examples:

- Buying shoes from Nike’s online store

- Ordering groceries from BigBasket

- Streaming from Spotify Premium

Why it matters:

B2C transactions are fast, high in volume, and focused on user experience, pricing, and trust.

2. B2B (Business to Business)

Here, businesses sell products or services to other businesses.

Examples:

- A wholesaler selling raw materials to a manufacturer

- A SaaS company offering software to other businesses

Why it matters:

B2B transactions are often higher in value, involve contracts, and rely on long-term relationships.

3. C2C (Consumer to Consumer)

This happens when individuals sell to other individuals through platforms that facilitate the process.

Examples:

- Selling a used phone on OLX or eBay

- Renting an apartment via Airbnb

Why it matters:

C2C transactions rely heavily on platform trust and user verification, since both sides are regular consumers.

4. C2B (Consumer to Business)

A less common but growing model where individuals sell products or services to companies.

Examples:

- A freelancer offering graphic design on Fiverr

- A photographer licensing photos to brands

Why it matters:

C2B flips the traditional model, giving individuals more power to earn directly from businesses.

5. B2G (Business to Government)

This involves companies providing goods or services to government agencies or departments online.

Examples:

- IT companies bidding for government contracts

- Vendors supplying office equipment through e-procurement platforms

Why it matters:

B2G transactions usually require compliance, transparency, and online bidding systems.

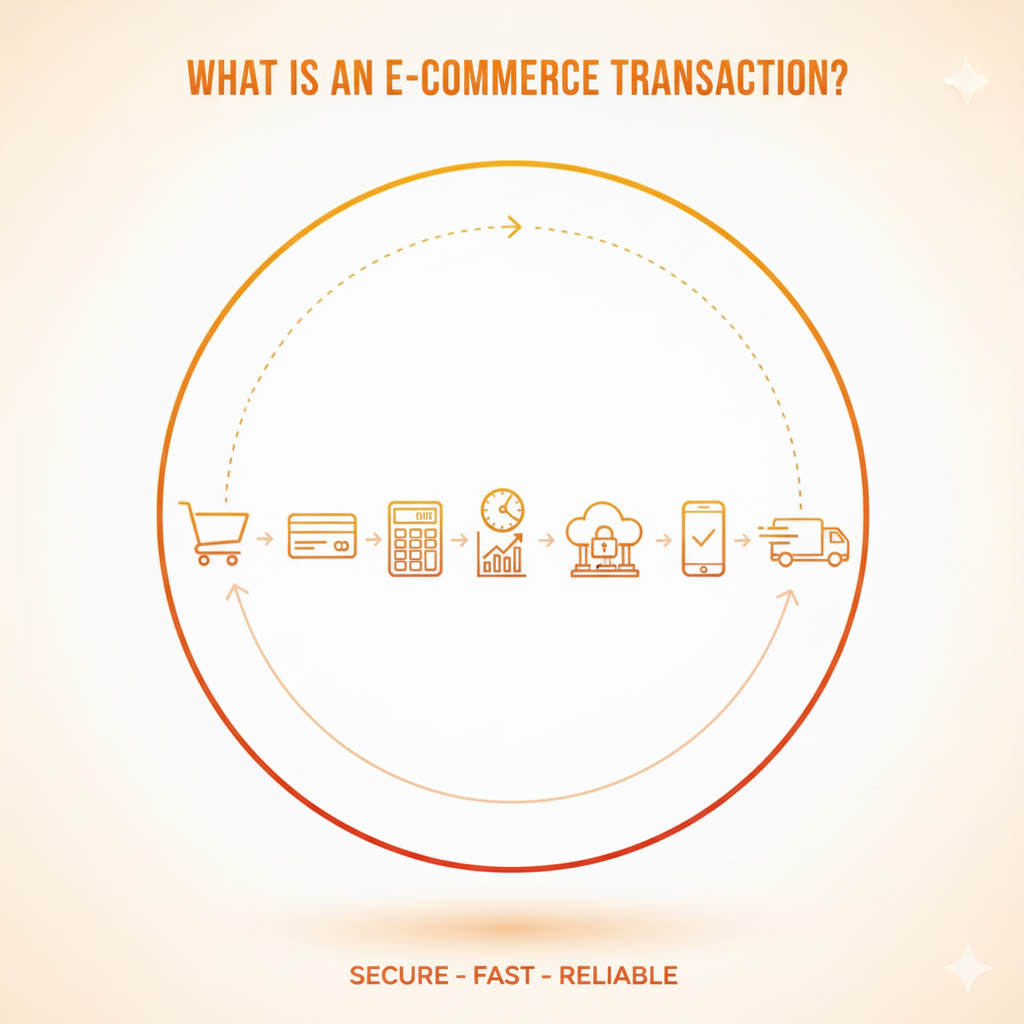

How an E-Commerce Transaction Works: Step-by-Step Breakdown

An e-commerce transaction might look simple from the outside, but behind the scenes, several steps happen in just a few seconds.

Let’s break it down:

Step 1: Product Discovery

The customer lands on your website or app — maybe through search engines, ads, or social media.

They browse products, read descriptions, check reviews, and compare prices.

At this stage, they’re just exploring — no commitment yet.

Step 2: Cart Addition and Checkout

Once they find something they like, they add it to the cart and proceed to checkout.

Here, the site collects shipping details, billing info, and payment preferences.

A well-designed checkout flow reduces friction and builds trust.

Step 3: Payment Authorization

The customer chooses a payment method — debit/credit card, UPI, PayPal, or wallet.

When they click “Pay,” the payment gateway encrypts the data and sends it to the bank for authorization.

This involves multiple players:

- Payment gateway: Handles encryption and secure transmission.

- Acquiring bank: Processes the transaction for the merchant.

- Issuing bank: Confirms if the buyer’s card/account has funds.

Once authorized, payment confirmation is sent back to the website in seconds.

Step 4: Order Confirmation

After successful payment, the customer sees a confirmation page or receives an email/SMS stating the order is confirmed.

This confirmation builds confidence and marks the official “transaction complete” point for the buyer.

Step 5: Order Fulfillment

Now the seller’s job begins — processing, packaging, and shipping the order.

The customer receives tracking updates until the product is delivered.

For digital products (like eBooks or software), the fulfillment is instant via download or email.

Step 6: Post-Purchase Support

After delivery, good sellers follow up — asking for feedback, managing returns, or offering loyalty rewards.

This phase strengthens trust and often leads to repeat transactions.

The Technology Behind E-Commerce Transactions

E-commerce transactions rely on several technologies working together to ensure speed, accuracy, and security.

Here are the main components:

1. Payment Gateways

They act as the bridge between your website and banks.

Examples: Razorpay, Stripe, PayPal, Paytm, and Cashfree.

They handle sensitive information like credit card numbers through encryption and tokenization.

2. Secure Sockets Layer (SSL) Certificates

SSL encrypts data between the customer’s browser and the server.

It ensures that no hacker can read or intercept information like passwords or card details.

3. Shopping Carts and Databases

Your website’s backend manages inventory, order details, and customer data through a database linked to your CMS or platform.

4. APIs and Integrations

Third-party APIs handle tasks like payment, shipping, and analytics.

For instance, when a customer pays, APIs connect your store to their bank instantly.

Security in E-Commerce Transactions

Security is everything in online transactions. If customers can’t trust your platform, they’ll never buy.

Here’s what protects e-commerce transactions today:

- Data Encryption: Prevents theft of sensitive information during payment.

- PCI DSS Compliance: Standards that all stores accepting card payments must follow.

- Two-Factor Authentication (2FA): Adds an extra verification layer during login or checkout.

- Fraud Detection Tools: Monitors unusual buying patterns or IP mismatches.

- Secure Payment Gateways: Trusted providers manage high-level security so you don’t have to.

As a store owner, displaying SSL badges, verified payment logos, and secure checkout icons increases customer confidence.

Advantages of E-Commerce Transactions

E-commerce transactions have reshaped global business — offering convenience, speed, and scalability.

Here’s what makes them so powerful:

1. 24/7 Availability

Unlike physical stores, online shops never close. Customers can buy anytime, anywhere.

2. Global Reach

Your store can sell to customers worldwide without physical presence or huge overheads.

3. Faster Processing

Transactions happen within seconds, compared to manual billing or in-person payments.

4. Better Record Keeping

Every transaction is automatically stored and traceable — useful for analytics and accounting.

5. Cost Efficiency

Lower operational costs mean better pricing and higher margins.

6. Personalized Marketing

Online data lets businesses track behavior and tailor offers to customers individually.

E-commerce has made business more data-driven, efficient, and customer-focused than ever before.

Challenges in E-Commerce Transactions

But it’s not all smooth. There are challenges businesses must navigate.

- Fraud and Scams: Fake orders, stolen cards, and chargebacks can hurt profits.

- Payment Failures: Gateway errors or poor internet connections can disrupt the process.

- Trust Issues: New customers hesitate to share payment info on lesser-known sites.

- Logistics Barriers: Delayed or damaged deliveries can ruin the entire experience.

- Data Privacy: Businesses must comply with privacy laws like GDPR to avoid legal risks.

The good news? With better technology and transparent practices, these risks can be minimized.

Real-World Example: How Amazon Handles E-Commerce Transactions

Amazon is a perfect example of transaction excellence.

Here’s how they do it right:

- Seamless checkout: Saved cards, 1-click ordering.

- Multiple payment options: Cards, wallets, EMI, net banking.

- Instant confirmations: Immediate email and app notifications.

- Strong trust layer: Buyer protection and easy refunds.

- Automation: Every transaction is tracked from order to delivery.

This efficiency is what keeps Amazon’s global transactions smooth across millions of users daily.

How to Improve E-Commerce Transactions on Your Store

If you’re running your own e-commerce business, here’s how to make transactions smoother and safer:

- Use a Reliable Payment Gateway: Choose one with strong fraud detection and high success rates.

- Simplify Checkout: The fewer clicks, the better. Avoid long forms or forced sign-ups.

- Optimize for Mobile Payments: Ensure UPI and wallets work smoothly on small screens.

- Add Security Badges: Display SSL, trust seals, and accepted payment logos.

- Provide Multiple Payment Methods: Cards, UPI, COD, PayPal — give users flexibility.

- Offer Transparent Refunds: Customers trust stores that promise (and deliver) easy returns.

- Monitor Failed Payments: Use analytics to find where users drop off.

Small improvements can drastically boost your conversion rate and reduce cart abandonment.

The Future of E-Commerce Transactions

E-commerce transactions are evolving fast with technology and consumer behavior. Here’s what’s coming next:

- Digital Wallet Dominance: UPI, PayPal, and Apple Pay are replacing traditional cards.

- Buy Now, Pay Later (BNPL): Flexible credit options like Klarna and Simpl make big purchases easier.

- Blockchain and Cryptocurrency Payments: Offering transparent, low-fee transactions.

- Voice Commerce: Buying through Alexa or Google Assistant.

- AI Fraud Detection: Smart systems catching suspicious activity in real-time.

- Cross-Border Simplification: Easier international payments with global payment processors.

The future is about speed, security, and simplicity making buying online as natural as breathing.

Key Takeaways

- An e-commerce transaction is any online exchange of goods, services, or value between a buyer and a seller.

- It includes browsing, checkout, payment, confirmation, and delivery.

- The main types are B2C, B2B, C2C, C2B, and B2G.

- Secure technology (like SSL, encryption, and gateways) makes transactions safe.

- Optimizing checkout, using trusted gateways, and offering multiple payments improve conversion rates.

- The future of transactions lies in automation, mobile payments, and AI-powered security.

E-commerce transactions are the invisible engine that powers every successful online business.

Wrap Up

Every click, order, and payment that happens online is part of a massive digital ecosystem built on trust and technology.

As a business owner, understanding e-commerce transactions helps you make better choices from selecting your payment gateway to designing your checkout page.

Remember: people don’t just want to buy; they want to buy safely, smoothly, and confidently.

The more seamless you make the transaction process, the more likely customers are to stay, shop again, and recommend your brand.

In the digital world, your transaction experience is your reputation so make it worth remembering.

FAQs About E-Commerce Transactions

An e-commerce transaction using a debit card is when you pay for something online directly from your bank account through your card.

Here’s what happens:

When you enter your debit card number, expiry date, and CVV on a website or app, the system connects with your bank through a payment gateway. The bank then checks if you have enough balance and sends you an OTP (one-time password) for verification. Once you confirm the OTP, the amount is deducted from your account and transferred to the seller.

It’s fast, secure, and happens within seconds.

But to make sure your debit card works for online purchases, you need to have the “E-com” (E-commerce) option activated — more on that below.

Example:

Let’s say you buy headphones online using your SBI or HDFC debit card. You enter your card details, receive an OTP, and confirm. That’s an e-commerce transaction made through your debit card.

There isn’t just one kind of e-commerce transaction. They come in different forms depending on who’s buying and who’s selling.

Here are the main types you should know about:

1. Business to Consumer (B2C)

This is the most common one. It’s when businesses sell products or services directly to customers.

Example: Buying a laptop from Amazon or a t-shirt from Myntra.

2. Business to Business (B2B)

When one business sells to another — like a manufacturer selling raw materials to a retailer.

Example: A software company selling enterprise tools to another firm.

3. Consumer to Consumer (C2C)

This happens on platforms where individuals sell to other individuals.

Example: Selling your old phone on OLX or eBay.

4. Consumer to Business (C2B)

Here, individuals offer their services or products to companies.

Example: A freelancer designing a logo for a business through Fiverr.

5. Business to Government (B2G)

This involves businesses providing goods or services to government agencies.

Example: A tech company selling cloud software to a government department.

6. Mobile Commerce (M-Commerce)

Any e-commerce transaction that happens through a mobile device or app.

Example: Ordering food through Zomato or paying via Google Pay on a mobile site.

Each type has its own process flow, but all share one core idea — buying and selling through digital means.

E-commerce (short for electronic commerce) is the process of buying and selling goods or services using the internet.

It’s not limited to physical products — it also includes digital downloads, online subscriptions, and even virtual courses.

Example:

Let’s say you visit Flipkart, find a phone case, add it to your cart, and pay online using your debit card or UPI. That’s e-commerce in action.

Even when you pay for Netflix, buy a digital book from Amazon Kindle, or subscribe to an online course — all of these count as e-commerce transactions.

Basically, if money is exchanged online for something of value — that’s e-commerce.

If your debit card isn’t working for online purchases, it likely means your E-com feature is turned off. Banks disable it by default for safety.

To activate your E-com transaction, follow these simple steps (it’s quick):

Method 1: Through Your Bank’s App or Net Banking

Log in to your banking app or website.

Go to ‘Manage Cards’ or ‘Debit Card Settings’.

Find the option for E-commerce (Ecom) transactions.

Toggle it ON for domestic or international payments (based on what you need).

Save changes.

Once done, you can immediately start making online payments.

Method 2: Through an ATM

Insert your debit card in an ATM.

Go to Card Services → Manage Usage → E-commerce Transactions.

Enable it.

Important Tip:

If you don’t shop online often, it’s a good idea to turn off E-com access when not in use. That way, you reduce the risk of unauthorized online transactions.

Mobile payment is one of the most popular ways to pay online today — especially with UPI, digital wallets, and payment apps.

Here’s how it works:

Customer chooses a product on an app or website.

At checkout, they select a mobile payment option (like Google Pay, Paytm, PhonePe, or Apple Pay).

The app connects securely with the payment gateway and your bank.

You approve the payment via UPI PIN, fingerprint, or face ID.

The payment is confirmed instantly, and the order gets processed.

Why It’s So Popular:

It’s faster than entering card details.

You don’t need to remember CVVs or OTPs every time.

It’s more secure thanks to encryption and biometric authentication.

Example:

You’re shopping on Myntra and choose “Pay via UPI.” You open Google Pay, approve the transaction, and boom — payment done. That’s a mobile e-commerce transaction in action.