How Much Does Shopify Take Per Sale?

Before starting my Shopify store, the biggest question in my mind was simple: how much does Shopify take per sale in actual numbers?

I kept seeing different answers online. Some said Shopify takes 2%, others said 5%, and some even claimed there were hidden charges. The confusion usually comes from mixing subscription fees, transaction fees, and payment processing fees.

In this guide, I’ll break everything down using real numbers, so you know exactly what Shopify takes from each sale.

Does Shopify Take a Percentage of Every Sale?

Yes, Shopify takes a percentage only in specific situations.

There are three different types of costs, and not all of them are per sale.

1. Shopify subscription fees

This is a fixed monthly fee, not per sale.

- Basic Shopify: around $39/month

- Shopify: around $105/month

- Advanced Shopify: around $399/month

Even if I make zero sales, I still pay this monthly fee.

2. Transaction fees

This depends on how I accept payments.

- 0% transaction fee if I use Shopify Payments

- 2% (Basic), 1% (Shopify), 0.5% (Advanced) if I use third-party gateways

3. Payment processing fees

These apply to every sale, no matter what.

For online card payments (Shopify Payments), the typical fee is:

- 2.9% + $0.30 per transaction (Basic plan example)

Shopify Pricing Plans Explained (Quick Overview)

Shopify Basic

- Cost: $39/month

- Online card fee: 2.9% + $0.30

- Best for: beginners and small stores

Shopify (Standard)

- Cost: $105/month

- Online card fee: 2.6% + $0.30

- Best for: growing stores

Advanced Shopify

- Cost: $399/month

- Online card fee: 2.4% + $0.30

- Best for: high-volume sellers

As the plan price increases, per-sale fees go down.

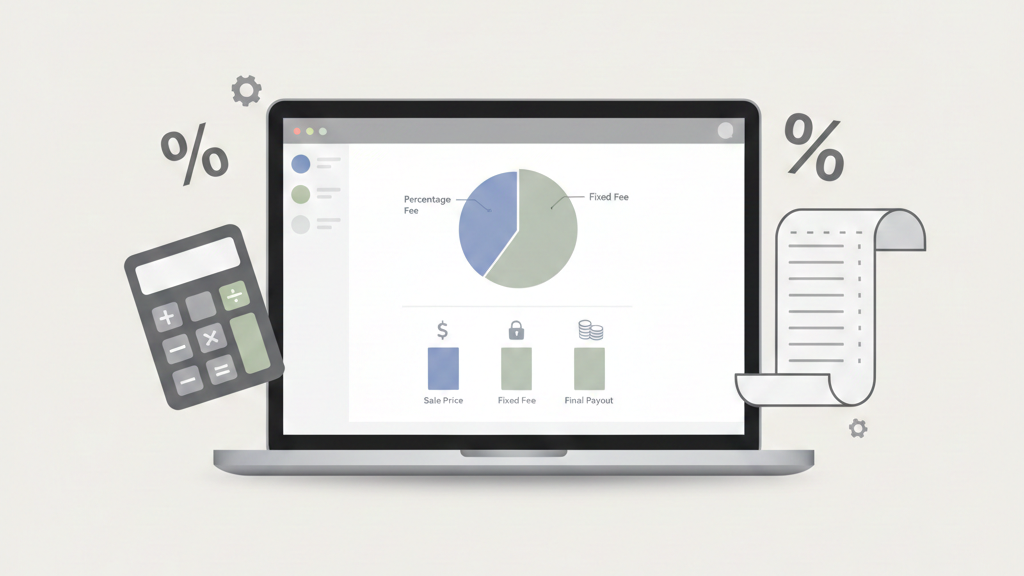

Shopify Transaction Fees (The Real Cost Per Sale)

Transaction Fees When Using Shopify Payments

If I use Shopify Payments, Shopify charges:

- 0% extra transaction fee

I only pay the payment processing fee.

Example:

- Sale price: $100

- Processing fee (2.9% + $0.30): $3.20

- Shopify transaction fee: $0

- I receive: $96.80

Transaction Fees When Using Third-Party Payment Gateways

If I use PayPal or another gateway, Shopify adds an extra fee.

On Basic Shopify:

- Shopify transaction fee: 2%

- Payment processor fee still applies

Example:

- Sale price: $100

- Shopify transaction fee (2%): $2.00

- Payment processor fee (~3%): $3.00

- Total fees: $5.00

- I receive: $95.00

This is why Shopify Payments matters.

Shopify Payment Processing Fees Breakdown

Credit & Debit Card Fees (Online Store)

Typical fees using Shopify Payments:

| Plan | Fee |

|---|---|

| Basic | 2.9% + $0.30 |

| Shopify | 2.6% + $0.30 |

| Advanced | 2.4% + $0.30 |

The fixed $0.30 hurts more on low-priced products.

Online vs In-Person Transaction Fees

Online payments

Higher fees because of fraud risk.

Shopify POS (in-person)

Lower fees, often around:

- 2.4% to 2.7%, depending on plan

In-person selling is usually cheaper.

Example: How Much Shopify Takes From a Sale

Let’s make this very clear with numbers.

Low-priced product ($10)

- Fee: 2.9% of $10 = $0.29

- Fixed fee: $0.30

- Total fee: $0.59

- I receive: $9.41

Mid-range product ($50)

- Fee: 2.9% of $50 = $1.45

- Fixed fee: $0.30

- Total fee: $1.75

- I receive: $48.25

High-priced product ($200)

- Fee: 2.9% of $200 = $5.80

- Fixed fee: $0.30

- Total fee: $6.10

- I receive: $193.90

This shows why higher order values reduce fee impact.

Additional Shopify Fees You Should Know About

Shopify doesn’t stop at per-sale fees.

App subscription costs

- Many apps cost $5–$30/month

- Advanced apps can go $50+

Theme costs

- Free themes: $0

- Paid themes: $180–$350 (one-time)

Domain name

- Around $14–$20 per year

Shopify POS Pro

- $89/month per location (optional)

These are optional but common expenses.

How to Reduce Shopify Fees Per Sale

Here’s what actually works for me.

Use Shopify Payments

Saves up to 2% per sale instantly.

Choose the right plan

If I sell $10,000/month, lower fees can save $50–$100 monthly.

Increase average order value

Selling one $100 order costs less in fees than two $50 orders.

Remove unused apps

Cutting just two $15 apps saves $360 per year.

Is Shopify Worth the Fees?

Cost vs value

Yes, I pay fees, but I get:

- Hosting

- Security

- Payments

- Scaling support

- No technical headaches

Who Shopify is best for

- Serious sellers

- Growing brands

- Long-term ecommerce businesses

When Shopify feels expensive

- Very low-margin products

- Hobby sellers with few orders

Shopify vs Other Ecommerce Platforms (Fee Comparison)

Shopify vs WooCommerce

- WooCommerce: lower platform fees, higher maintenance cost

- Shopify: predictable monthly + per-sale fees

Shopify vs Etsy

- Etsy charges listing + transaction + payment fees

- Shopify gives full brand control

Shopify vs Wix

- Wix is cheaper for small stores

- Shopify scales better for high sales

Final Verdict

So, how much does Shopify take per sale?

- Shopify does not take a flat commission

- Fees depend on plan + payment method

- On average, expect 2.5%–3% per sale

My honest advice: don’t fear Shopify fees. Focus on pricing products correctly, increasing order value, and choosing the right plan. When used properly, Shopify’s fees are predictable and manageable.